In the fast-paced world of trading and investment, strategies can often resemble intricate puzzles, comprised of countless variables and dynamic market conditions. Yet, even the most meticulously crafted approaches can fall victim to unseen flaws.

This is where market data playback comes into play—a powerful tool that allows traders and analysts to rewind the clock and scrutinize market actions through a fresh lens. By re-examining the sequence of trades, price movements, and market events, investors can uncover insights that may have previously gone unnoticed.

Perhaps a subtle shift in market sentiment caused a ripple effect in your strategy, or maybe a miscalculated indicator led you astray. In this article, we will explore how leveraging market data playback can illuminate the blind spots in your trading methodologies, ultimately refining your approach and steering you towards more informed, strategic decisions.

Importance of Analyzing Historical Market Data

Analyzing historical market data serves as a cornerstone for refining trading strategies and enhancing overall market acumen. When you delve into past price movements, you unearth invaluable patterns, trends, and anomalies that could easily slip under the radar during real-time trading.

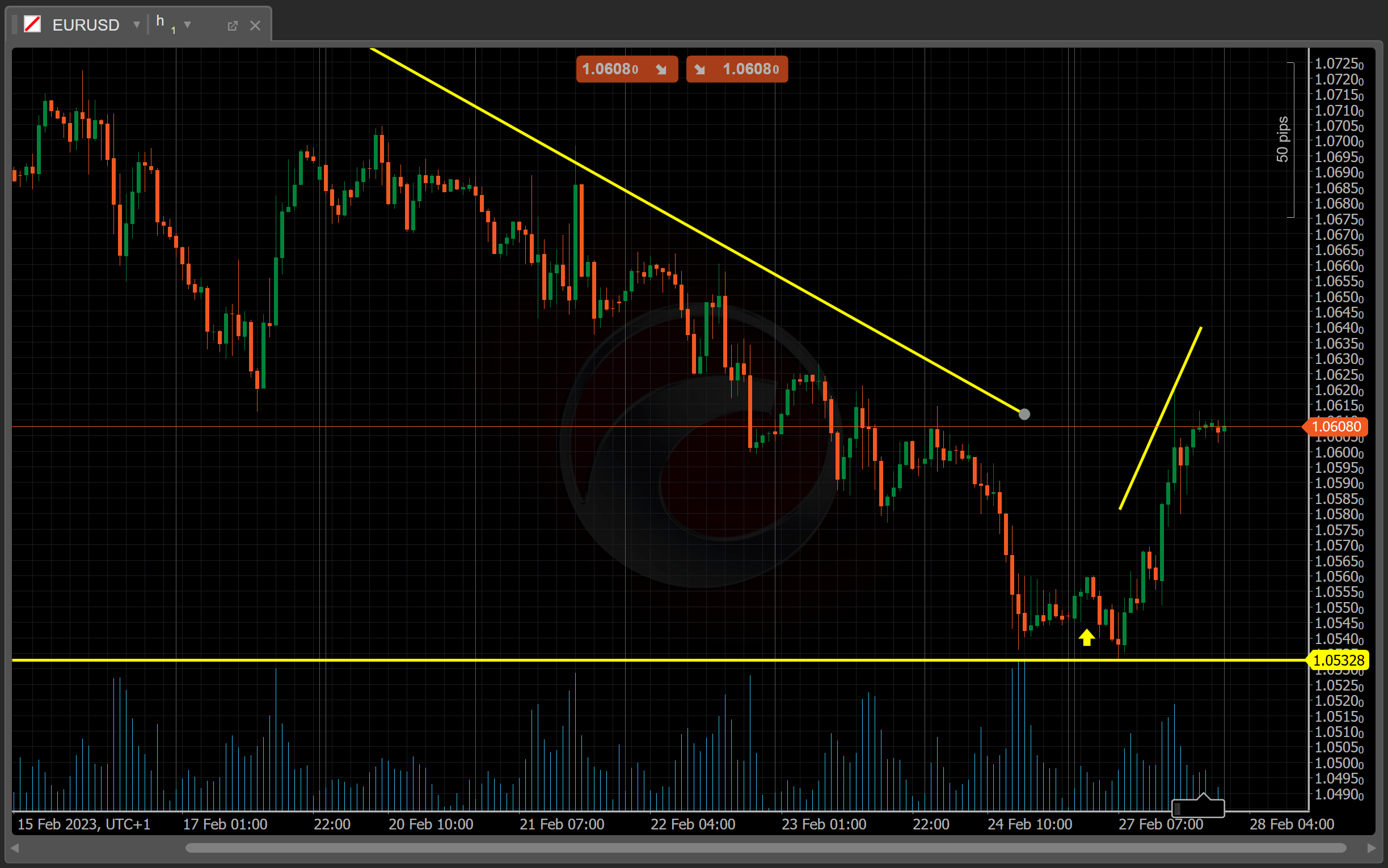

A free bar replay chart, for example, is an excellent tool for this purpose—it allows traders to simulate past market conditions and observe how their strategies would have performed, providing hands-on insights into potential weaknesses or strengths. This retrospective lens not only illuminates the reasons behind past successes and failures but also equips traders with the foresight needed to navigate future market ebbs and flows.

For instance, a particular strategy may have thrived in a bull market but faltered in volatile conditions—insights gained from tools like bar replay charts can reveal these nuances, providing a blueprint for adaptation. In essence, understanding how previous market behaviors correlate with your current strategy allows you to transform potential pitfalls into opportunities for growth, creating a more resilient trading framework.

Identifying Patterns and Trends

Identifying patterns and trends within market data playback is a vital step in refining your business strategy. By meticulously analyzing historical data, one can unveil recurring behaviors that might have gone unnoticed in real-time activities.

Consider the subtle shifts in consumer preferences during seasonal transitions or the impact of external events on sales fluctuations. These insights often reveal a narrative—one that illustrates not only what has happened but also hints at what may come next.

However, it’s not just about spotting the obvious; sometimes, the most compelling revelations emerge from the interplay of various data points, where a combination of metrics creates a mosaic that informs strategic pivots. The deeper the dive into the data, the clearer the picture becomes, illuminating areas of potential risk and uncharted opportunities alike.

In this complex dance of numbers, savvy businesses distinguish themselves by adapting swiftly, guided by the trends that their data so eloquently narrates.

Gaining Insights into Decision-Making Processes

Understanding the intricacies of decision-making processes is essential for any organization aiming to refine its competitive strategy. Market data playback is a powerful tool that unveils the hidden layers of these processes, revealing not only what decisions were made but also why they were made.

By analyzing patterns and trends within past data, stakeholders can uncover discrepancies between intended and actual outcomes—a gap that often illuminates flawed assumptions or overlooked variables. Imagine a company that anticipated a surge in demand, only to find its supply chain inadequately prepared.

Such insights, drawn from historical data analysis, can drive a pivotal shift in how teams approach future decisions, encouraging a more nuanced evaluation of market signals. In this complex landscape, understanding the why behind decisions becomes just as crucial as the decisions themselves, paving the way for adaptive strategies that are not merely reactive, but proactively informed.

Conclusion

In conclusion, leveraging market data playback can significantly enhance your trading strategies by revealing underlying flaws that may not be evident during live trading. By revisiting past market conditions and analyzing your decisions in real-time, traders can identify critical missteps and refine their approaches for improved performance.

The integration of tools such as the free bar replay chart enables a more intuitive examination of market movements, allowing traders to dissect their strategies with precision. Ultimately, embracing this method not only fosters a culture of continuous improvement but also empowers traders to make informed, data-driven decisions that can lead to greater success in the competitive trading landscape.